The 45-Second Trick For San Diego Home Insurance

The 45-Second Trick For San Diego Home Insurance

Blog Article

Protect Your Home and Properties With Comprehensive Home Insurance Coverage

Recognizing Home Insurance Protection

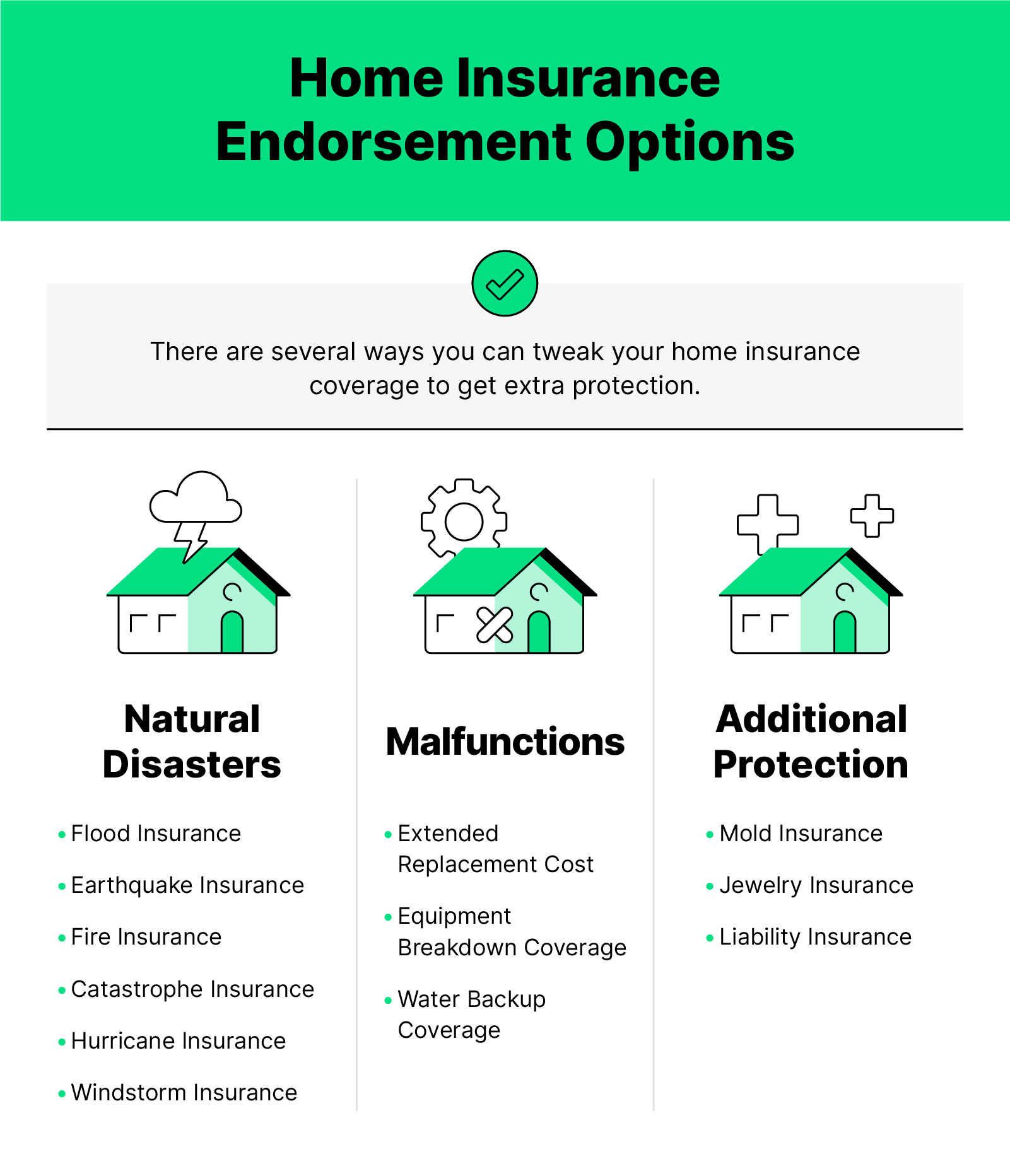

Recognizing Home Insurance Insurance coverage is important for property owners to safeguard their building and properties in situation of unforeseen events. Home insurance policy commonly covers damage to the physical structure of your home, personal valuables, responsibility security, and additional living costs in case of a covered loss - San Diego Home Insurance. It is important for house owners to grasp the specifics of their plan, including what is covered and excluded, plan limitations, deductibles, and any kind of added recommendations or riders that might be required based on their private conditions

One trick aspect of recognizing home insurance policy protection is knowing the distinction in between real cash money worth (ACV) and replacement price protection. ACV takes devaluation right into account when compensating for a covered loss, while substitute price coverage reimburses the full cost of changing or repairing the harmed residential or commercial property without considering depreciation. This difference can considerably impact the quantity of compensation gotten in the occasion of a case. Home owners need to likewise understand any coverage restrictions, such as for high-value items like jewelry or art work, and think about purchasing extra coverage if required. Being educated concerning home insurance coverage ensures that house owners can properly protect their ownerships and financial investments.

Advantages of Comprehensive Plans

When exploring home insurance protection, property owners can acquire a much deeper recognition for the protection and tranquility of mind that comes with extensive policies. Comprehensive home insurance policies provide a broad range of advantages that go beyond fundamental coverage.

Furthermore, thorough plans typically include coverage for liability, offering protection in instance a person is injured on the building their explanation and holds the home owner liable. Extensive policies may also offer extra living costs coverage, which can assist pay for temporary housing and various other needed prices if the home comes to be uninhabitable due to a protected event.

Customizing Insurance Coverage to Your Demands

Customizing your home insurance protection to straighten with see page your specific requirements and situations guarantees a tailored and reliable protecting approach for your building and possessions. Personalizing your insurance coverage enables you to resolve the distinct aspects of your home and belongings, giving a more thorough guard versus possible dangers. Eventually, personalizing your home insurance coverage provides peace of mind recognizing that your assets are secured according to your distinct situation.

Safeguarding High-Value Possessions

To sufficiently safeguard high-value properties within your home, it is essential to analyze their worth and take into consideration specialized insurance coverage alternatives that accommodate their one-of-a-kind worth and relevance. High-value properties such as fine art, jewelry, antiques, and collectibles might exceed the protection restrictions of a conventional home insurance plan. Therefore, it is important to deal with your insurance provider to make sure these things are properly secured.

One means to protect high-value possessions is by arranging a different policy or recommendation specifically for these things. This customized insurance coverage can give greater insurance coverage restrictions and might additionally include added defenses such as coverage for unintended damage or mysterious disappearance.

In addition, prior to obtaining coverage for high-value properties, it is advisable to have these items expertly appraised to develop their existing market price. This assessment paperwork can help improve the insurance claims process in case of a loss and make certain that you receive the proper repayment to change or repair your beneficial possessions. By taking these positive steps, you can appreciate comfort knowing that your high-value assets are well-protected against unpredicted situations.

Insurance Claims Process and Plan Management

Final Thought

In final thought, it is necessary to ensure your home and assets are effectively secured with extensive home insurance policy protection. It is vital to focus on the protection of your home and assets through comprehensive insurance coverage.

One secret aspect of recognizing home insurance protection is recognizing the difference between actual money worth (ACV) and substitute expense insurance coverage. House owners ought to additionally be aware of any kind of coverage limitations, such as for high-value products like jewelry or art work, and think about acquiring added coverage if necessary.When checking out home insurance policy coverage, home owners can obtain a deeper recognition for the protection and peace of mind that comes with comprehensive policies. High-value properties such as fine art, jewelry, antiques, and antiques may go beyond the protection restrictions of a common home insurance policy.In conclusion, it is essential to guarantee your home and possessions are properly secured with thorough home insurance protection.

Report this page